Creating balance as a commercial real estate broker has always been an important driver in my career and in my personal life. I would rate myself anywhere from moderately successful to completely disastrous in this endeavor depending on when you asked me (or my wife). It seems that the world of commercial real estate investment turns in such a way that there is always too much or too little to do. Rarely is there consistency in workflow. Balance is always a very elusive aspiration. Mix in family, hobbies, and community obligations and it can be difficult to do everything well.

From my early days in the industry as a commercial real estate broker, it always fascinated me to see how different clients and peers tackled this issue. Some have been very strict in maintaining not only a work-life balance but also a balance within their work as a commercial real estate broker. I have watched others who have embraced the “all in” mentality, burning the candle at both ends to take advantage of opportunities while they existed.

A few months ago, I read an article written by Alex Lawrence, a local entrepreneur, professor, and friend that was published in Utah Business magazine. I thought that he did a great job addressing these issues as they relate to entrepreneurship but also found them very applicable to me as a commercial real estate broker.

I have included the article below along with a link to the full article at the bottom of the page. Thanks Alex.

Life-work balance is always something people seem to talk about. Any busy person worth their salt has had the balance discussion a time or 10. How do you balance all that you have going on? As an entrepreneur, work, family, hobbies, service, fun, sleep and more are all pulling at you in what feels like a never-ending tug of war between a variety of people and items that need time and attention.

There isn’t enough time in the day to do it all! So one must seek balance, the proper way to keep the scales in harmony. Place an equal amount of one thing on the left, and an equal amount of the other on the right, and poof! Your life is balanced and you get to do and have it all. Queue the peaceful music as you find this Zen-like life of balance.

Nope.

Balance is difficult to achieve because the concept itself has inherent flaws. How does one find two things that are different, yet weigh the exact same amount? Even a tiny bit more or less weight on one side will make the scales fall out of alignment.

What weighs more? Consider placing some of these things on opposite sides of the scale:

In my mind, none of these things weighs equally the same as its counterpart. While it can be close, it is never exactly identical in weight, and, by definition, the scale must be out of balance. This is why entrepreneurs should consider the concept of a basket instead of scale.

Instead of thinking about your personal life and work life like a scale that needs to be balanced, think of them as a basket that needs to be woven. Each piece of the basket is a strand of life. One piece that is intertwined is your business. Another is your family. Yet another is your health. Hopefully you get the picture. Notice that each weave on the basket is touching another. Notice that they wind in and out and overlap. Like water, the demands of life always seem to find the holes and weak spots of our figurative basket. In order for the basket to truly hold its contents, the fit must be tight!

While I still struggle mightily with this, the tightly woven basket seems a good representation of a well-rounded life.

Need to work? Work hard.

Want to play? Play with reckless abandon.

Spending time with your family? Do it.

Going to stay at the office late? Make it worth it.

Kids need a little league coach? Volunteer.

Out of shape? Exercise.

Sleep deprived? Stop it. Get to bed.

With the basket concept, most of this can happen simultaneously. Do your best not to use work as an excuse to avoid family, friends and exercise.

Prior to coming to Weber State I was an entrepreneur for a long time. I found it very difficult to make choices that were good for my health. Over the years, I gradually became an overweight, under-slept and over-stressed person who ate poorly, never exercised and rarely pursued hobbies outside of work. My justification was that sleep was for the weak or the dead. Ultimately, this lifestyle led to back surgery that brought my life to a screeching halt. This was my wake up call.

Since that time, I’ve made a concerted effort to exercise, sleep more and recreate enough to help lower my weight and eliminate blood pressure medications. This has led to a strong overall improvement of my physical and mental health, both of which positively impact my overall energy levels. The ROI of this effort, measured as an ability to “basket weave” my family and work lives, has been extremely high.

Finally, it is important to note that it’s a good idea to sometimes put the technology away and focus on family. You have to do it. The basket concept is not a license to pay less attention to your spouse, or work when you should be with your kids. You have to use your brain and your gut to make sure you aren’t allowing your business to always be No. 1. The basket can’t leak! Weave it all together in a healthy, shared way.

With practice, time and discipline you can weave it all together in a healthy, shared way. As an entrepreneur, it’s a never-ending effort. But keep at it and perhaps you’ll find that elusive balance you sought in the first place.

Alex Lawrence is vice provost and visiting professor in entrepreneurship at Weber State University. He can be reached via twitter.com/_AlexLawrence or at alexanderlawrence@weber.edu.

– See more at: http://www.utahbusiness.com/articles/view/have_it_all#sthash.uOZlQWME.dpuf

Sincerely,

Your local commercial real estate broker.

We are pleased the announce the sale of the Layton Call Center located at 2195 North University Park Boulevard in Layton, Utah. The property consists of an 81,525 square foot building sitting on 9.69 acres adjacent to the successful Legend Hills Development northeast of the I-15 Antelope Drive exit.

Please contact us for more detailed information or for info on commercial real estate in Utah.

Thanks, Brandon (brandon@northwoodgrp.com)

In recent months I have included a couple of updates on the residential real estate market. I do so because although the residential and commercial markets are different, they are correlated and driven by many of the same factors.

Matt Green, Regional Director of Keller Williams Utah produces some very propriety and interesting breakdowns of the Utah market. I have included an attachment to his assessment of the SLC market. Breakdowns of Park City and of the Davis, Weber & Utah County markets are available upon request.

2015 – Q2 Market Report Graphs – Salt Lake County

A couple of the highlights of the report include:

Please let me know if you have additional questions.

Brandon

We are pleased to announce the sale of a 6,000 square foot retail building located at 141 North Main Street on historic main street in Kaysville, Utah. The building was acquired by a restaurant group that will operate under the name of Orlando’s.

Please inquire for additional information regarding the sale of retail properties Utah — brandon@northwoodgrp.com

We are pleased to announce the sale of the 1500 South Industrial Building in Salt Lake City, Utah to Falgers, Inc. The Northwood Group represented the buyer in the acquisition of this 120,000 square foot, 4 tenant, industrial investment. The project is an older property with amazing functionality in terms of clear height, column spacing, loading, etc for a property of its age. With rents cast during the down turn the market the property is well-positioned to take advantage of the strengthening market.

Please contact for additional information relating to this sale or other industrial properties Utah.

Your commercial real estate broker Utah, announces the sale/leaseback of a 13,000 square foot office building located in Farmington, Utah. Details of the sale include:

More information regarding the sale available upon request from your commercial real estate broker Utah.

The Utah Chapter of NAIOP recently held its 2014 Year End Commercial Real Estate Symposium titled “Destination Utah”. The event provided a fantastic overview of the Utah Commercial Real Estate Market. Overall, the commercial real estate market in Utah is very strong boasting low vacancy rates, increasing lease rates and a robust commercial real estate investment market that is still providing opportunities for private and institutional investors alike.

There were several take-away’s for me that I found very interesting and telling:

As you can see the market is very strong with a bright 2015 forecast limited primarly by supply of good commercial real estate investment product.

Following are a few other market statistics that are worth highlighting:

OFFICE MARKET

INDUSTRIAL MARKET

RETAIL MARKET

Although difficult to find there are still opportunities to invest in commercial real estate in Utah. Those already invested here are positioned well and may have more value than they may have realized.

Please contact me at brandon@northwoodgrp.com for additional detailed market information or to discuss any commercial real estate needs that you may have.

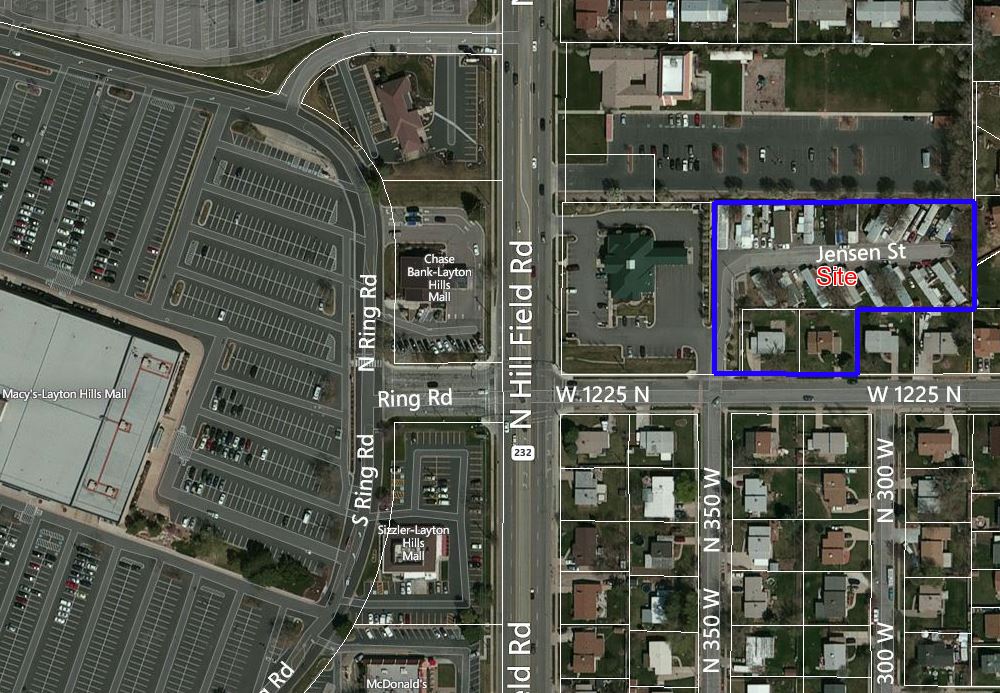

The Northwood Group is pleased to announce the sale of the J&M Mobile Home Park located in Layton, Utah. Contact us for more info on mobile home parks for sale in Utah.

The J&M Mobile Home Park is a uniquely situated commercial real estate investment located just off Hill Field Road across the street to the east from the Layton Hills Mall. It is a rare mix of quiet living and amazing access to services and amenities. All of the mobile homes are owned by the occupants, which is increasingly rare in small mobile home parks. The mobile home park continues to perform well with strong occupancy. The property was priced at an 8% cap rate.

Additional information regarding this sale is available upon request. Find more mobile home parks for sale in Utah by contacting us today.

Increasingly, conversations with investors lead to the hot topic of the historically low interest rates, their affect on current values, and the impact that rising interest rates will have both on value and commercial real estate investment activity. It seems that there are as many diverging opinions on this as there are investors and we won’t know who is right until we are looking in the rear view mirror.

I am right along side these investors as I try to map out strategies for myself as well as the investors that I work with. Opinions on these issues affect everyday decisions such as:

Obviously the answers to these questions vary based on the investor and the portfolio objectives but they are interesting to ponder as we consider strategy in the coming years.

It was fascinating to me to watch during peak of the market in 2005-2007 as cap rates went to record levels. Many investors stepped back saying that these prices were too far beyond historical levels. Others said that commercial real estate investment had arrived as an “asset class” and that the historical cap rates no longer had relevancy. We know how that turned out. We are now looking at cap rates that look a lot like what they did prior to the recession. Are we walking in front of that same train? Time will tell but there are some very significant differences between 2005-2007 and today:

I recently read an article written by William E. Hughes and published in Commercial Investment Real Estate Magazine that addressed cap rate and interest rates. I have included the full article as well as a link below. He shares a graph that is very telling. In 2006, the spread between cap rates and the 10 year treasury note was only 200 bps. Although cap rates are similar, there still remains over a 400 bps difference between cap rates and the 10 year treasury note. The argument being that there is room for compression in that spread where interest rates could rise without an immediate correlating increase in cap rates. Additionally, rising interest rates would indicate strengthening in the economy and additional consumer confidence which should also increase confidence in commercial real estate investment strengthening cap rates further.

I thought his article did a great job succinctly addressing a very complex and important topic to our industry.

Strong capital flows, from both equity and debt sources, are boosting the liquidity of the commercial real estate market and driving transaction activity. Equity capital of all stripes — from local investors and 1031 exchanges to institutions that include real estate investment trusts, private equity, and sovereign wealth funds — have accelerated acquisitions and portfolio repositioning to capitalize on the low cost of capital, consistent revenue streams, and rising prospect for appreciation.

At the same time, lenders are back in full force just a few years after the banking crisis. The volume of commercial mortgages, after dropping about 10 percent during the credit crisis, reached a new high at midyear, rising by $140 billion over the past 12 months. Commercial banks have picked up activity in both fixed- and floating-rate loans, commercial mortgage-backed securities volume is strong a second year in a row, insurance companies and government-sponsored agency lenders remain competitive, and mezzanine funds abound.

The wave of liquidity has pushed property prices to record or near-record levels in core markets and is in the process of working its way to secondary and tertiary markets. Property sales are growing in nearly every metro, but investors are increasingly targeting assets in non-core markets as they pursue yields and opportunities with less fervent bidding activity.

The increased liquidity reflects the generally positive outlook for commercial real estate, but the strengthening economy has also supported momentum. Gross domestic product has risen steadily over the last several years — aside from temporary setbacks such as the polar vortex of the first quarter — and the outlook remains positive through the end of 2014.

In addition, steady hiring has finally surpassed the 8.7 million jobs lost during the recession, and by year-end, the U.S. economy should employ 1.7 million more people than the pre-recession peak. Though many remain underemployed or have left the labor force, the hiring trends continue to point in the right direction. This combination of steady growth has allowed the economy to spur demand for commercial real estate while minimizing risks of inflationary pressure.

Job gains have supported limited income growth, but the surging stock market has helped household wealth significantly. As of the end of first quarter 2014, U.S. household wealth was up 19 percent from its 2007 peak and more than 47 percent from the trough in 2009. That has supported rising consumer confidence and substantive gains in retail sales. These steady positive factors will support a growing demand for commercial real estate space on a broad basis.

Several years of low interest rates have helped the real estate market recover from its downturn with a lot less pain than would have been imagined in the wake of the 2008 credit crisis. The rapid recovery in asset values and rebound in lending have reduced the severity of what many thought would be a second thrift liquidation-style event. Increasing economic strength in recent months has lifted the prospects that the Federal Reserve will begin raising its short-term rates early next year, posing limited risk to the real estate momentum.

However, interest rates are unlikely to rise quickly enough to slow the economic momentum because demand for U.S. Treasurys remains robust. International investors in particular have sought out the security of U.S. Treasurys as a range of uncertainties plague parts of the world. While China has cut back its purchases, investors from Japan, Europe, and the Middle East have picked up the slack. Risks of escalating aggression in Ukraine and the Middle East cement the perception of the U.S. as a beacon of stability.

What’s more, the Fed is under little pressure to increase rates. The U.S. economy is improving, but inflation has remained in check and the Fed remains focused on the large number of workers that have dropped out of the workforce or are underemployed. The November elections are another wildcard that could re-ignite gridlock in Washington, D.C., and stall the nascent growth cycle.

Consequently, the Fed is unlikely to raise the federal funds rate until the signs that the economy is heating up really accelerate. Presently, most anticipate that this will not happen before the middle of next year, but there is a chance that the Fed will surprise and begin tightening liquidity sooner.

Once rates do begin to rise, the impact on commercial real estate may be nominal. Historically, capitalization rates have not moved in lockstep with interest rates, with tightening spreads being the norm during most growth cycles. As a result, should rates begin to rise later this year or early in 2015, it remains unlikely that cap rates will escalate in pace.

Although cap rates are near historical lows today, the risk premium — the spread between 10-year Treasury yields and cap rates — persists near historical highs. If Treasury yields rise because of positive factors — such as strong economic growth — investors will have a more optimistic outlook about property performance and be willing to absorb some of the rate increase in the form of lower risk premiums. The bottom line is that, aside from a major exogenous shock, interest rates and monetary policy are not likely to have a watershed impact on the economy or commercial real estate in the near term.

In a real sense, the moderate pace of the economic recovery has been good for commercial real estate performance. Usually new construction comes roaring back after recessions, but incremental growth and the fresh memory of the severe recession has kept development largely in check. Construction is creeping back, particularly for apartments, but it is predominantly centered in core areas of the strongest metros. Supply factors will be slower to emerge and less problematic this cycle than in past recoveries.

Apartments. Apartments have been a favorite asset class for investors since the downturn. Not only did fundamentals remain more stable during the recession, but debt was available from government-sponsored agencies when other lenders tightened their lending criteria. Earlier this year, Fannie Mae and Freddie Mac reined in their lending, and their share of multifamily loans fell to 47 percent in 2014, down from 87 percent in 2009, but it appears they are increasing their allocations through the second half of the year. In addition, banks, insurance companies, institutions, and CMBS programs have stepped up their pace of lending, producing a highly competitive lending environment. Loan rates are mostly in the 4 percent range but can go as low as the mid-3 percent range depending on the term, leverage, and borrower credentials.

With pricing of premium assets in core markets selling with cap rates in the 3 percent to 4 percent range, investors are increasingly moving to secondary and tertiary markets in search of yield. But even those markets are becoming more expensive, as average cap rates for high-quality apartment properties reach below 7 percent.

Office. Investor demand in core markets remains intense. In the first half of 2014, 40 percent of the $50 billion of office sales came from six core markets where class A properties trade at cap rates in the 4 percent range. However, investors pursuing stronger yields and a less-competitive bidding process are increasingly branching into secondary and tertiary markets, where sales increased by 30 percent during the first half of the year. With suburban offices in many metros offering investors a 150-basis point yield premium relative to CBD office assets, investors have begun to search beyond core locations.

Readily accessible debt capital has also fueled activity this year as loan spreads have tightened by 25 bps from last year. Rates range between 4.4 percent and 5.25 percent for 10-year loans with moderate leverage, and leverage up to 70 percent is common. All lender types have become increasingly active, but national banks have increased their share of lending activity to 26 percent. CMBS will also be a positive factor, and it has already increased lending to this sector by $6.1 billion from last year.

Retail. Nationally, vacancy rates of retail properties have been tightening, as modest absorption has topped the limited construction pipeline. In the year ending in the 2Q14, only 37.4 million square feet of space, or 0.5 percent of total space, came on line. This gradual tightening of vacancies has recently sparked rising asking rents, but rents still remain about 11 percent below their pre-recession peak.

Despite the still-soft performance climate for many retail assets, investor demand is strong, particularly for single-tenant properties that are leased to national tenants. The volume and number of transactions between $1 million and $10 million reached a record $10 billion in the 1H14, while price per square foot and cap rates also hit new heights. Multi-tenant sales are also strong, although shy of peak prices. The availability of debt continues to improve, though lenders remain focused on stabilized properties. Local and regional banks are increasing market share, while CMBS is dominant in secondary and tertiary markets.

Industrial. Investors seeking relative stability and diversity to augment existing portfolios have increased demand for industrial assets. In addition, institutional investors have targeted portfolio assets to build a critical mass of assets in a given locality. Cap rates are tightening for all industrial segments, with warehouses making the biggest gains. Warehouse cap rates averaged 7.2 percent nationally in 1H14, and top properties in major markets traded at yields under 6 percent. Flex properties averaged 7.8 percent cap rates nationally in the first half.

Lenders are actively lending on industrial properties, although underwriting remains relatively conservative. National, international, and regional banks increased their share of industrial loans to 62 percent in 2013, up from 48 percent the prior year. Lenders have largely targeted debt yields of 8.5 percent to 9 percent, producing leverage of 70 percent, while offering longer term rates of 4.6 percent to 5.5 percent.

William E. Hughes is senior vice president and managing director of Marcus & Millichap Capital Corp., based in Irvine, Calif. Contact him at william.hughes@marcusmillichap.com.

– See more at: http://www.ccim.com/cire-magazine/articles/323690/2014/11/capital-markets-outlook#sthash.pcEbhkHc.dpuf

The Northwood Group is pleased to announce the sale of the Mountainland Office Building in Layton, Utah.

The building, featuring unique “creative” office space, was acquired by a local advertising agency.

The building is approximately 7,000 square feet including office space and a lease to a local pizza restaurant. More information on the sale is available upon request — 801-593-5500 or brandon@northwoodgrp.com.