I thought you might find this following article published in the Salt Lake Tribune interesting. It describes the diversity of the Utah economy and the resilience that it creates in the Utah market.

As Utah’s star rises after 2 recessions, lessons linger

Diverse economy has made Utah resilient, downturns have left it forever chastened.

By Paul Beebe

| The Salt Lake Tribune

First Published May 17 2013 11:56 am • Last Updated May 18 2013 09:38 pm

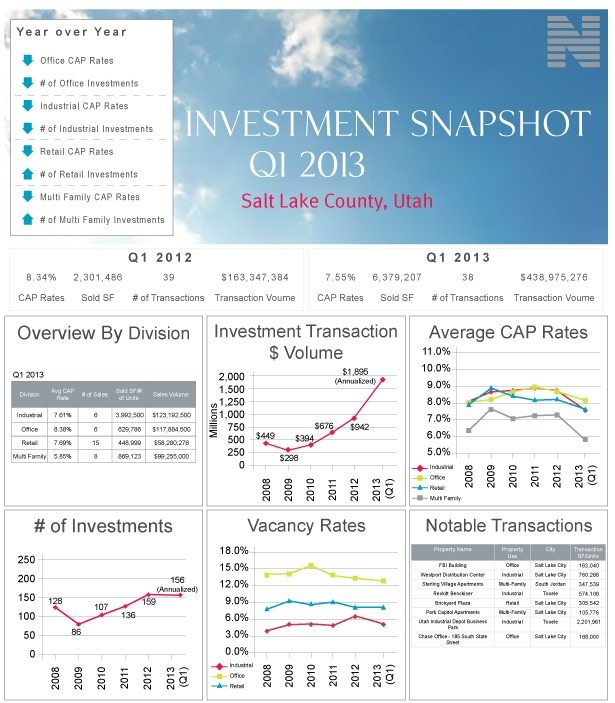

With few exceptions, the pattern of jobs distributed across Utah is largely unchanged after two recessions since the turn of the new century.That underscores not only the unusual diversity of the state’s economy, but it increases the likelihood employment in the state will grow faster than in the U.S. for some time.It’s true the Great Recession gave construction a good drubbing , manufacturing employment ebbed and flowed between 2000 and 2012, and the information sector seems in permanent decline. But the other industries that make up the Utah economy have in total added tens of thousands of jobs — many with high-paying salaries — during the 13-year period that saw one of the wildest boom and bust cycles since the 1930s.”Those of us who lived through it will never be quite the same. But I think the economic forces in the Utah economy remain pretty much the same,” said Natalie Gochnour, chief economist at the Salt Lake Chamber and associate dean at the University of Utah’s business school.It’s been a rough-and-tumble ride, starting with the technology-led recession of 2001, which undermined storied Utah names such as WordPerfect and Iomega. Next was the remarkable stretch of growth that started in 2004 and propelled Utah to truly impressive heights.”For the fourth year in a row, Utah’s economy outperformed the nation in 2007,” economists said then, ticking off unrivaled growth in employment, personal income, housing prices and population in their annual report to then-Gov. Jon Huntsman.But the recession of 2007-2009, which started with the subprime mortgage crisis, ended all that in a big way and probably changed forever how Utahns view their financial circumstances and their appetite for risk-taking. Today’s watchword is prudence.

Record numbers of Utahns were thrust out of work as the downturn mauled the housing market and as other industries retrenched. Few people alive had ever seen Utah business conditions so depressed. Yet today, Utah again is a star. Employment at the close of 2012 was 16 percent higher than in 2000. U.S. employment was up only 1.4 percent, according to the Bureau of Labor Statistics. Utah’s modern economy seems second to none.

“Basically, these numbers show that Utah’s economy is quite diverse. It was quite diverse in 2000 and that trend holds [today],” said Juliette Tennert, Gov. Gary Herbert’s chief economist.

“Utah’s economy continues to evolve, continues to be very dynamic [and] continues to maintain economic diversity, which is a really good thing,” Tennert said. “Economic diversity helps to support economic stability. The more diverse an economy, normally we see a faster recovery from a recession, which we’ve seen in the most recent data.”

A Salt Lake Tribune analysis of employment data shows that eight of the state’s 11 industrial sectors added almost 190,000 jobs during the 2000-2012 period. At the head of the list was the education, health and social services sector, which accounted for close to one of every three new jobs. Its share of total employment rose to 13.1 percent of all jobs in the state from 9.5 percent at the start of the millennium.

Given that the state’s population jumped 24 percent, to 2.8 million people, that’s not surprising, economists say. Demand for private education services, health care and other social services was driven by rising numbers of young families with children, as well as by migrants from other parts of the U.S. and foreign countries. (Public education falls in a different sector — government. It was the No. 2 job generator, although its share of total employment barely budged.)

But another factor was at play. Three sectors — construction, manufacturing and information lost jobs and share; the trade, transportation and utilities sector’s share of total employment also shrank, although it still added jobs. As those sectors’s portions of total employment got smaller, the remaining sectors by default were bound to get larger — most notably education, health care and social services — and probably will continue to gain in importance over time.

“That sector is predominantly health care, and we have absolutely been pouring more of our collective resources into [it] as we’ve aged, as technology has improved the quality of health care — and as we’ve been unable to control cost increases,” Gochnour said.

John Maynard is one of some 62,000 people who landed jobs in health care. After being laid off from his welding job in 2008, Maynard searched high and low to find another opening in construction. After a year of picking up temporary work wherever he could, Maynard gave up and went back to school to be trained as a surgical technician. Now 39, he works for a surgical clinic in Bountiful. He has health insurance, a 401(k) retirement plan and vacation benefits, none of which he had before.

“I wish I would have learned this [lesson] when I was 18. I hated that I was laid off and I had to start all over again. But it will pay off in the long run,” he said.

The information sector shed nearly 3,700 jobs during the period as its share of total employment fell 10.5 percent. In part, the declines were tied to cutbacks at newspapers and other Utah media. Another reason was the collapse of the dot-com bubble that produced the 2001 recession. A third factor emerged as the frenzy to lay fiber-optic cables and ramp up other infrastructure to support the explosion of Internet and cellphone service subsided. Carrie Mayne, chief economist at the state Department of Workforce Services, thinks the information sector will not grow appreciably until some new technology is invented.

The mining sector — specifically oil and gas production — witnessed the most explosive dramatic employment growth. The number of jobs jumped almost 72 percent between 2001 and 2012, although most of the gain occurred in the past couple of years. Oil and gas production historically has followed a boom-and-bust pattern, but Mayne thinks the latest rise in jobs, particularly in the hydrocarbon-rich Uintah Basin in eastern Utah, will be permanent. Fracking technology allows drillers to extract more oil and gas from old fields and opens up new areas for development.

“All of the economic development people, the people in the state (Office of Energy Development), they all seem to think that this oil and gas [upturn] is not going to go away, that it’s not just a boom that is going to realize a bust later on. This may be something that booms for quite awhile,” Mayne said.

Leisure and hospitality jobs jumped more than 22 percent. Although Utah’s ski resorts and iconic scenery get most of the public’s attention, it was restaurant employment that took off in the 2000-2012 period. More than 16,400 jobs were added, a 25 percent gain driven largely by population growth.

Tim Ryan and Joe Fraser took note of the demand for new restaurants, and in 2009 they opened their first ‘Bout Time Pub and Grub, at Jordan Landing in West Jordan. Today, Ryan and Fraser own seven ‘Bout Time restaurants along the Wasatch Front. Their eighth location will open in Kimball Junction this week.

The pair plunged into the business of food because they believed the market for pub fare and drink four years ago was underserved. Many national and regional chains had avoided Utah because of its restrictive liquor laws.

“That created an opportunity for us. We already live in Utah. We are Utahns, and we understand the licensing requirements and the marketplace a little bit better,” Ryan said. Today, the company employs 200 people, including 25 full-time staffers.

On another front, the professional and business services sector increased its share of total employment as the number of firms providing scientific and technical expertise continued to grow amid the state’s march to becoming more of an information-based economy.

However, temporary staffing employment is also inside the sector. Although the number of temporary employees today is largely unchanged from 2000, there has been a surge since 2009, when the recession ended. Employment in that area is up 76 percent. Mayne said employers typically bring on temporary workers in the early stages of an economic recovery. When it’s clear the recovery is real, employers then shift to hiring full-time workers.

Employment numbers were “very steady until the economic downturn, but now we are seeing definite growth,” said Barbara Fryar, area manager for staffing company Manpower Inc. “Right now, I know that Salt Lake City has one of the best outlooks for jobs in 2013, and we found that out through our employment outlook survey, which we do quarterly.”

Twenty-two percent of the companies Manpower surveyed said they plan to increase their staffs during the April-through-June quarter. Just 4 percent said they would decrease their payrolls.

Gochnour frequently speaks publicly about the diversity and power of Utah’s economy. Still, the downturn has left its mark. Almost four years after the Great Recession ended, large numbers of Utahns remain unemployed and face an uncertain future, she said.

“I do believe that this [recession] has caused a reset of sorts. For example, about 70,000 Utahns are unemployed right now. I’m absolutely certain that many of those have to be retrained, so the reset is toward higher job skills, and education has become more important,” Gochnour said.

One lesson of the past six years is that Utahns have learned to live within their means. Savings are up, borrowing is tempered, debts are down — shifts that will have an impact on the economy in coming years. For example, townhomes and condominiums are becoming more popular, and some builders are constructing smaller homes.

“We overextended ourselves, both at a household and at a business level” leading into the Great Recession, Gochnour said. “There’s a lot of caution out there.”