Creating balance as a commercial real estate broker has always been an important driver in my career and in my personal life. I would rate myself anywhere from moderately successful to completely disastrous in this endeavor depending on when you asked me (or my wife). It seems that the world of commercial real estate investment turns in such a way that there is always too much or too little to do. Rarely is there consistency in workflow. Balance is always a very elusive aspiration. Mix in family, hobbies, and community obligations and it can be difficult to do everything well.

From my early days in the industry as a commercial real estate broker, it always fascinated me to see how different clients and peers tackled this issue. Some have been very strict in maintaining not only a work-life balance but also a balance within their work as a commercial real estate broker. I have watched others who have embraced the “all in” mentality, burning the candle at both ends to take advantage of opportunities while they existed.

A few months ago, I read an article written by Alex Lawrence, a local entrepreneur, professor, and friend that was published in Utah Business magazine. I thought that he did a great job addressing these issues as they relate to entrepreneurship but also found them very applicable to me as a commercial real estate broker.

I have included the article below along with a link to the full article at the bottom of the page. Thanks Alex.

Life-work balance is always something people seem to talk about. Any busy person worth their salt has had the balance discussion a time or 10. How do you balance all that you have going on? As an entrepreneur, work, family, hobbies, service, fun, sleep and more are all pulling at you in what feels like a never-ending tug of war between a variety of people and items that need time and attention.

There isn’t enough time in the day to do it all! So one must seek balance, the proper way to keep the scales in harmony. Place an equal amount of one thing on the left, and an equal amount of the other on the right, and poof! Your life is balanced and you get to do and have it all. Queue the peaceful music as you find this Zen-like life of balance.

Nope.

Balance is difficult to achieve because the concept itself has inherent flaws. How does one find two things that are different, yet weigh the exact same amount? Even a tiny bit more or less weight on one side will make the scales fall out of alignment.

What weighs more? Consider placing some of these things on opposite sides of the scale:

In my mind, none of these things weighs equally the same as its counterpart. While it can be close, it is never exactly identical in weight, and, by definition, the scale must be out of balance. This is why entrepreneurs should consider the concept of a basket instead of scale.

Instead of thinking about your personal life and work life like a scale that needs to be balanced, think of them as a basket that needs to be woven. Each piece of the basket is a strand of life. One piece that is intertwined is your business. Another is your family. Yet another is your health. Hopefully you get the picture. Notice that each weave on the basket is touching another. Notice that they wind in and out and overlap. Like water, the demands of life always seem to find the holes and weak spots of our figurative basket. In order for the basket to truly hold its contents, the fit must be tight!

While I still struggle mightily with this, the tightly woven basket seems a good representation of a well-rounded life.

Need to work? Work hard.

Want to play? Play with reckless abandon.

Spending time with your family? Do it.

Going to stay at the office late? Make it worth it.

Kids need a little league coach? Volunteer.

Out of shape? Exercise.

Sleep deprived? Stop it. Get to bed.

With the basket concept, most of this can happen simultaneously. Do your best not to use work as an excuse to avoid family, friends and exercise.

Prior to coming to Weber State I was an entrepreneur for a long time. I found it very difficult to make choices that were good for my health. Over the years, I gradually became an overweight, under-slept and over-stressed person who ate poorly, never exercised and rarely pursued hobbies outside of work. My justification was that sleep was for the weak or the dead. Ultimately, this lifestyle led to back surgery that brought my life to a screeching halt. This was my wake up call.

Since that time, I’ve made a concerted effort to exercise, sleep more and recreate enough to help lower my weight and eliminate blood pressure medications. This has led to a strong overall improvement of my physical and mental health, both of which positively impact my overall energy levels. The ROI of this effort, measured as an ability to “basket weave” my family and work lives, has been extremely high.

Finally, it is important to note that it’s a good idea to sometimes put the technology away and focus on family. You have to do it. The basket concept is not a license to pay less attention to your spouse, or work when you should be with your kids. You have to use your brain and your gut to make sure you aren’t allowing your business to always be No. 1. The basket can’t leak! Weave it all together in a healthy, shared way.

With practice, time and discipline you can weave it all together in a healthy, shared way. As an entrepreneur, it’s a never-ending effort. But keep at it and perhaps you’ll find that elusive balance you sought in the first place.

Alex Lawrence is vice provost and visiting professor in entrepreneurship at Weber State University. He can be reached via twitter.com/_AlexLawrence or at alexanderlawrence@weber.edu.

– See more at: http://www.utahbusiness.com/articles/view/have_it_all#sthash.uOZlQWME.dpuf

Sincerely,

Your local commercial real estate broker.

We are pleased the announce the sale of the Layton Call Center located at 2195 North University Park Boulevard in Layton, Utah. The property consists of an 81,525 square foot building sitting on 9.69 acres adjacent to the successful Legend Hills Development northeast of the I-15 Antelope Drive exit.

Please contact us for more detailed information or for info on commercial real estate in Utah.

Thanks, Brandon (brandon@northwoodgrp.com)

In recent months I have included a couple of updates on the residential real estate market. I do so because although the residential and commercial markets are different, they are correlated and driven by many of the same factors.

Matt Green, Regional Director of Keller Williams Utah produces some very propriety and interesting breakdowns of the Utah market. I have included an attachment to his assessment of the SLC market. Breakdowns of Park City and of the Davis, Weber & Utah County markets are available upon request.

2015 – Q2 Market Report Graphs – Salt Lake County

A couple of the highlights of the report include:

Please let me know if you have additional questions.

Brandon

We are pleased to announce the sale of a 6,000 square foot retail building located at 141 North Main Street on historic main street in Kaysville, Utah. The building was acquired by a restaurant group that will operate under the name of Orlando’s.

Please inquire for additional information regarding the sale of retail properties Utah — brandon@northwoodgrp.com

We are pleased to announce the sale of the 1500 South Industrial Building in Salt Lake City, Utah to Falgers, Inc. The Northwood Group represented the buyer in the acquisition of this 120,000 square foot, 4 tenant, industrial investment. The project is an older property with amazing functionality in terms of clear height, column spacing, loading, etc for a property of its age. With rents cast during the down turn the market the property is well-positioned to take advantage of the strengthening market.

Please contact for additional information relating to this sale or other industrial properties Utah.

Although driven by many different factors, residential and commercial real estate markets are inter-related in many ways. Savvy commercial real estate investors should pay careful attention to statistics such as natural population growth, net in-migration, unemployment rates, and of course interest rates.

All of these items greatly affect investors perceived vitality of a given market. Population growth leads to a greater need for housing and retail properties and also creates demand for employment. With employment growth comes the need for additional industrial and office commercial real estate. These are some of the reasons that Utah has been such a sweet heart for commercial real estate investment over the last 5 years. Commercial real estate investors inside and outside the Utah market love the vitality of this young and growing population and business leaders have recognized Utah as a great place to locate their companies to be able to capture much of this young talent.

Based on these sentiments you would expect that the residential housing market would be off the charts along the Wasatch Front — but it is not. 2014 actually saw slight decreases in activity over 2013. I recently read an article written by Spencer Sutherland published in Utah Business Magazine in their January issue. It discusses many of the residential Utah real estate trends over the years and what the market is currently seeing. I have attached the link to the article as well as the full text of the article below. A few of the interesting statistics (statewide) I found interesting were:

The articles offers potential suggestions for the trends that are being seen. As I look at these factors I always compare the statistics to what I am actually seeing in the market. The residential market actually appears to be healthy. Neither sellers nor buyers have a strong advantage. Growth appears to be steady which is promising. I might argue that the decline in new single family homes is as much as a result of a lack of available land opportunities for homebuilders as it is a decline in demand. I have had a very difficult time procuring large tracks of residential land for my private as well as governmental clients.

Provided that the major economic indicators – population growth, unemployment, and interest rates remain positive I maintain a very positive outlook on the residential market and subsequent commercial real estate investment market in Utah.

Please enjoy the article below.

http://www.utahbusiness.com/articles/view/room_to_grow

It’s been more than five years since the official end of the Great Recession, and all signs point to a recovered Utah economy. In 2014, the state’s employment numbers not only reached pre-recession levels, but they also surpassed them. Those numbers came after a strong 2013, where both home sales and home prices jumped by 10 percent. That’s why 2014 was supposed to be the year the real estate market finally left the recession in the rearview mirror—but that didn’t happen.

After three quarters of flat sales and prices, the year ended with slumping sales—despite historically low interest rates. What happened? And what should Utahns expect of the real estate market in 2015?

The Past

Tough times for real estate are nothing new for Utah. In fact, since the early 1970s, the state has experienced five unique housing cycles, each with peaks and valleys.

The late 1970s were notable because of an all-time high in new home construction, driven by the needs of baby boomers. Despite the growing population and high job growth rate, homebuilders got ahead of themselves and built more speculation homes than the market could support, resulting in a steep decline for housing.

Tough times returned in the 1980s, when the over-building from the ‘70s, combined with a recession, led to a 67 percent decline in housing activity. To make matters worse, interest rates climbed to more than 18 percent as the Federal Reserve tried to address the inflation caused by rising energy prices.

All of that turned around in the late ‘90s and early 2000s. With a growing number of Utahns hitting the ideal age for home buying—ages 25 to 34—the real estate market expanded into new territory. First-time home buyers were building new homes in Lehi and Eagle Mountain, baby boomers were moving into new homes in South Jordan and Riverton, and sub-7 percent interest rates made it a great time to buy a second home in Washington County. But then things fell apart for the Utah real estate industry.

In 2008, housing activity dropped by 50 percent. A year later, single-family construction fell to the lowest level since 1989. House prices fell by 20 to 25 percent and the state lost 40,000 construction jobs.

Today, the state is still working to dig its way out of the deepest housing decline in more than four decades. James Wood, director of the Bureau of Economic and Business Research at the University of Utah (BEBR), has spent years tracking Utah’s housing ups and downs. He says this cycle’s recovery has been slower than any other.

“Four years from the trough [of a housing cycle], we’re usually back to 80 percent of the pre-recession level peak,” Wood says. “We’re just barely over 50 percent now.”

Wood says the causes of the sluggish recovery fall into two broad categories: cyclical and structural. Cyclical factors include job loss, interest rates, price declines and negative equity. What makes the slow recovery so baffling is that despite the fact the state has successfully bounced back from most of the cyclical factors—meaning employment is at all-time high, interest rates have remained low, home prices have come back up, and foreclosures have dropped off—home sales and new construction still haven’t caught up.

Structural factors—those that will affect the future of housing—are equally problematic. One structural factor is a change in Utah’s demographics. “Our age structure is not quite as favorable as it was a few years ago,” Wood says. “The 18 to 30 age group—the group that forms new households—is not as large a percent of the population as it once was and that will be the case for the next few years.” Additionally, the state’s in-migration has slowed, resulting in less need for

new housing.

Income has also become an important structural factor. “If you look at long-term numbers, median household income has not changed much in real terms over the last 30 years. In fact, since 2007, median income in Utah has dropped by 7 percent,” Wood says. “When incomes are low, people postpone forming a household. They also double up in houses or stay with their parents.”

Another potential structural change is housing preference. “Some people have made the case that millennials are not as predisposed to home ownership as previous generations,” Wood adds. However, it’s unclear whether millennials are choosing to live in apartments because of a true preference or as a result of economic constraints like trouble qualifying for a loan in a tightened lending market. “The jury is still out on that structural change,” Wood says.

The Present

The impact of a slow recovery goes far beyond homeowners, buyers and sellers. Homebuilders have struggled as well. It has been tough for new construction to compete with the low price of foreclosed properties, and declining equity has kept many buyers from moving up to a more expensive home. As a result, building is down in every major county in the state.

Related industries have also felt the pain. Utah’s manufacturing sector fell by 20,000 jobs during the recession. Local companies that supply the construction industry with goods such as glass, gravel, sand, trusses and concrete took the hardest hit.

Housing woes have also impacted the retail space. “The weakness in the recovery of retail sales is traceable to the uncertainty and the unease that homeowners have now,” Wood says. “With less equity, [homeowners] are a little more hesitant to use equity for retail purchases.”

Factoring in inflation and a population increase of 250,000 Utahns, retail sales are 15 to 20 percent lower than before the recession. “I would make the case that part of that drop is due to the heavy debt load people were carrying, combined with falling housing prices. That contributed to uncertainty and caution with retail activity,” Wood says.

Not surprisingly, the retail segments that are having the hardest time recovering are furniture stores and home and garden retailers. “Those are big employers and they lay people off,” Wood says. “You can see it directly. The weakness in the recovery and the weakness in the housing sector affected retail sales in those two categories and we’re still seeing it.”

Despite the overall sluggishness of the housing recovery, there are plenty of positive indicators for the future. The market is seeing decent gains at the higher end of the price spectrum, with home sales in the $500,000 to $750,000 range up 9 percent year over year and the $300,000 to $500,000 range up 12 percent.

Why the lift in more expensive homes? “We saw a period where people who didn’t have to move chose not to because of the uncertainty in the economy,” says Rick Southwick, president of the Utah Association of Realtors. “People have some confidence again. They’re taking advantage of improvements in their equity position, selling existing homes, and moving up to larger, more expensive homes.”

Mid-level homes, ranging from $200,000 to $300,000, are also moving. Houses below that range, however, are not. “There haven’t been as many sales of starter homes because of a lack of inventory and qualification limits,” Southwick says.

Qualifying for a home loan continues to be tough, especially for first-time buyers. “We see statements in the media that lending is starting to loosen up, but we haven’t really seen that happening yet,” Southwick adds. “Right now you still have to have excellent credit to get a loan.”

The Future

Over the past year, there have been pockets of strong home sales around the state. Through September 2014, Utah and Tooele counties saw an increase of 6 percent in sales and Davis County’s sales jumped by 5 percent. “These areas are outside of the city center, so land is less expensive,” Southwick says. “There is still room to grow and there is a lot of new construction.”

Home prices increased the most in Uintah County, where the average sale was up 13 percent over the previous year. This increase was driven largely by in-migration to the county, stemming from the boom in oil and gas production in the area. Wasatch County home prices increased by 6 percent, driven in part by the area becoming a popular second home destination.

Across all counties in the state, 2014 sales benefitted from unexpectedly low interest rates that hovered around 4.1 percent and even dropped below 4 percent toward the end of the year.

Southwick anticipates that 2015 will largely look like 2014. Neither buyers nor sellers will have a noticeable advantage, though it’s still common for sellers to pay some part of the buyer’s closing costs.

It seems unlikely, however, that interest rates will remain as low. The National Association of Realtors expects rates to hit 5 percent by midyear. Despite the uptick, the association predicts the number of both new and existing homes to increase.

Despite the association’s optimism, Southwick worries about the impact of rising interest rates. “I’m not sure how much of an interest rate the market can sustain in the current economy,” he says. “From a historical perspective, 5 percent is still a great rate; it’s just higher than what people are used to. In the lower price ranges, it has an impact on what people are able to afford. If we see enough of a rise in interest rates that could put some downward pressure on prices.”

Your commercial real estate broker Utah, announces the sale/leaseback of a 13,000 square foot office building located in Farmington, Utah. Details of the sale include:

More information regarding the sale available upon request from your commercial real estate broker Utah.

Utah Investment Real Estate

I often get asked in everyday conversation, “How is the commercial real estate market in Utah?” That is an interesting question to answer because there as so many sub-components to that question.

It has been a very interesting commercial real estate market in Utah during the last several years as we have seen an increasingly strong appetite for investment properties while lease rates, in general, have not seen the increases that might be expected based on increasing property values. The easy answer to the question about the market is “Commercial real estate investors (new investors to Utah and repeat investors) continue to aggressively seek properties in Utah pushing cap rates down and prices higher”. With that being said, how long can this run last? Prices started to recover as early as 2010, starting slowly and continuing to heat up to today. Many would argue that we are in the final phase of the typical real estate cycle. The question is just how long that cycle will last – 1, 2, 3 years?

I recently read an article written by Kenneth P. Riggs, Jr. published in Commercial Investment Real Estate Magazine titled Sky High Prices? Investors don’t seem to mind. In his article Kenneth points out many of the strengths in the economy such as the more than 3 percent GDP growth with continued low inflation and unemployment. Based on his analysis of this market cycle compared to past market cycles, the commercial real estate market may have another 18 to 24 months of run left. He has a few very interesting observations regarding availability of capital compared to underwriting standards. I love his quote that, “…be worried when the market starts to say, This time is different.”

“Price is what you pay; value is what you get.” — Warren Buffet

As we look to 2015 and beyond, the commercial real estate market is enjoying much positive press and continues to be a favored asset class relative to stocks, bonds, and cash. After the most recent commercial real estate downward cycle in third quarter 2008, followed by a rebound in 1Q10, we are at a new crossroads where prices are clearly outpacing valuations. This is the final phase of our up cycle, and the key question is, how long can this phase run? When we think about investments and investment cycles, we are coming to realize that the more things change, the more they stay the same. In other words, be worried when the market starts to say, “This time it is different.”

In our search for how prices and values are aligning themselves, we first need to examine the economy. The outlook for the U.S. economy is much brighter than it has been since before the Great Recession. Besides more than 3 percent growth in gross domestic product in 2Q14 and 3Q14, inflation remains low and the unemployment rate declined to 5.8 percent in October 2014. In fact, job growth has improved enough that employers are on pace to add the most jobs on an annual basis since 1999, according to the Bureau of Labor Statistics.

However, a variety of headwinds is still holding back the progress that many economists had been predicting, with each setback causing forecasters to recalibrate their expectations. These recalibrations have been triggered by a workforce participation rate that has declined to 1978 levels, as the wages of the majority of workers remain relatively stagnant. In addition, the federal debt has ballooned to nearly $18 trillion, while major entitlement programs are underfunded. The housing sector has improved slightly, but the young adults we have relied on in the past to purchase homes are burdened with oversized amounts of student debt. Furthermore, many of the economies in Europe and Asia are contracting, and territory disputes from the Ukraine and Russia to Iraq and Syria have given rise to new acts of terrorism. However, in the end, the U.S. economy appears to have many resilient elements in place to withstand future disruptions in the financial markets.

Each quarter, Real Estate Research Corp., a Situs company, surveys some of the nation’s leading institutional investors about the economy and reports this information in the quarterly RERC Real Estate Report. As demonstrated in Figure 1, commercial real estate has been consistently rated higher than the alternatives, even as the economy has been recovering.

Despite the macroeconomic uncertainties, the global and domestic markets have provided investors more capital than they know what to do with. With investors searching for a place to park this capital (with good risk-adjusted and safe returns), the result has been asset prices pushed to all-time highs — which is making the market nervous. We see this in the stock market, with record-high performance, and we see it with commercial real estate, which, with its attractiveness as an asset class, including return performance, ability to hedge against inflation, and tangible nature, has attracted a great deal of capital.

Put stocks and real estate together and you get an idea of just how much in demand these two asset classes are. According to Bloomberg, investors are rewarding retailers’ efforts to spin their properties into real estate investment trusts. Sears Holdings recently announced plans to create a REIT for its properties, and shares increased 31 percent.

RERC also examines the amount of capital available for investment and compares it to the underwriting discipline. As shown in Figure 2, investor ratings for capital availability have greatly outpaced the discipline (or underwriting standards) for capital in 3Q14. It is worth noting that the last time the availability of capital outpaced discipline to this degree was in 2Q07 — shortly before the credit crisis that preceded the Great Recession.

The comparison of the availability and discipline of capital shows that we are again at an inflection point. The flood of capital chasing commercial real estate continues to pressure property prices to increase, especially for high quality assets in top markets. Some investors have noted that, given high prices, there is already too little product to invest in, which further drives prices higher and returns lower.

However, RERC expects values and prices to continue to increase as long as interest rates stay low. If RERC’s history of availability of capital versus the underwriting discipline holds up, this bull commercial real estate market has another 18 to 24 months to run. This is not to say the market is right, but it is the market.

Although the Federal Reserve has concluded its recent quantitative easing program, monetary policy remains accommodative, with the federal funds rate remaining at 0 percent to 0.25 percent for “a considerable period of time.” The Fed’s target unemployment rate has been reached, but its target inflation rate is elusive, and growth remains slower than expected.

The market and most investors anticipate that the Fed will raise short-term interest rates in mid-2015, stating that it is too risky for the Fed to leave rates at current record lows much longer (in case the rates need to be lowered again when there is another recession). Others believe that the Fed will leave the funds rate very low for several years due to global pressure, as troubled economies in the rest of the world would be forced to pay higher interest rates.

As shown in Figure 3, risk-free rates in other developed economies have followed the U.S. trend to keep rates low, and as shown in Figure 4, 10-year Treasury rates have been declining for several decades. Despite the Fed’s clear message about their intent to increase U.S. Treasury rates at some point, some investors have become complacent, expecting Treasury rates — as well as interest rates — to stay low for much longer. Continuing low interest rates will be another significant benefit for commercial real estate investors.

As long as Treasury rates and interest rates remain low, the global investment environment for commercial real estate will be very attractive. Investors will continue to purchase real estate, prices will continue to increase, and values will continue to chase prices, as capitalization rates on a broad market perspective will further compress.

As shown in Table 1, RERC’s value vs. price rating for commercial real estate overall dipped slightly to 5.3 on a scale of 1 to 10, with 10 being high, during 3Q14. However, with the midpoint of the rating scale at 5.0, a rating of 5.3 indicates that value vs. price can still be found in commercial real estate overall, despite the slight decline in this rating during the past few quarters.

On a property sector basis, the value vs. price rating increased for each of the sectors (except for the hotel sector) during 3Q14. As shown, the industrial sector retained the highest value vs. price rating among the property types. However, all sector ratings were higher than the midpoint of 5.0, which means that prices still have room to climb before properties become overpriced (compared to their value) — at least as long as interest rates remain low and cap rates have room to further compress.

Additional ConsiderationsAs 2015 continues, commercial real estate investors are encouraged to keep in mind the following points:

|

Office. The office market continues to struggle. The vacancy rate was 16.8 percent in 3Q14, which was only 10 basis points lower than a year ago, according to Reis. Despite that, effective rents increased 2.7 percent to $23.94 per square foot year over year. In addition, according to Real Capital Analytics, 12-month trailing transaction volume increased more than 27 percent to $121 billion in 3Q14 compared to the previous year, and prices psf increased by 6 percent to $245. RERC’s required pre-tax yield rate (internal rate of return) dipped to 7.9 percent, and the required going-in cap rate decreased to 6.1 percent in 3Q14. Figure 5 illustrates the spreads between RERC’s required pre-tax yield rates and going-in cap rates and 10-year Treasurys. Vacancy is expected to drop to 16.3 percent and rents to increase 3.7 percent by the end of 2015, according to Reis. Some metros are expected to outpace expectations, such as Portland, Ore., with stagnant cap rates in the office market, and Minneapolis, which is expected to see slightly higher rental growth than the national average over the next couple years.

Industrial. Vacancy in the industrial sector decreased to 9.0 percent in 3Q14, according to Reis, and was accompanied by effective rental growth of 2.5 percent YOY to $4.45 psf. Transaction volume increased by 6.0 percent, with prices increasing 17.3 percent to $77 psf over the past year, per RCA. RERC’s required pre-tax yield rate for the industrial sector declined to 7.7 percent, while the required going-in cap rate decreased to 6.0 percent in 3Q14. Reis forecasts the industrial vacancy rate to decline to 8.0 percent by 2016, and for effective rent to grow by 3.3 percent. Industrial vacancy is expected to decline even more in some markets, such as Sacramento, Calif., and Orlando, Fla.

Multifamily. The vacancy rate for the apartment sector increased slightly in 3Q14 to 4.3 percent, while the effective rent rose 3.91 percent during the past year to $1,117 per unit, according to Reis. As reported by RCA, 12-month trailing transaction volume increased 6.2 percent YOY to $104 billion in 3Q14, as the price increased 21.5 percent to $128,259 per unit, a new high. RERC’s required pre-tax yield rate declined to 7.0 percent, while the required going-in cap rate declined to 5.0 percent. Reis notes that due to expected completions of 444,000 units over the next two years, vacancy is likely to increase to 4.9 percent in 2015 and to 5.1 percent in 2016, although vacancy in some metros (San Diego, for example) is not expected to increase as much. Effective rental growth of 3.1 percent in 2015 and 2.6 percent in 2016 is expected.

Retail. According to Reis, retail vacancy declined slightly to 10.3 percent in 3Q14, while effective rent increased 1.91 percent to $17.07 psf. Transaction volume increased 8.1 percent YOY, with pricing increasing 24.8 percent to $214 psf, as investors have been purchasing higher quality retail properties. RERC’s required pre-tax yield rate decreased to 7.8 percent in 3Q14, while the required going-in cap rate declined to 6.1 percent, although this has had more to do with abundant capital and easier financing than improving fundamentals. However, Reis projects that vacancy will be 100 bps lower at 9.3 percent and rents will step up to 3.3 percent annual growth in 2016. Retail properties in some metros — especially Florida markets like Miami and Orlando — offer strong investment opportunities due to improving fundamentals.

Hospitality. Smith Travel Research reports that U.S. hotel occupancy rose 3.9 percent YOY to 62.7 percent during the week of November 9-15, 2014. Revenue per available room and the average daily rate increased 8.6 percent to $72 and 4.6 percent to $115, respectively, according to PKF Hospitality Research. Hotel volume increased to $33 billion on a 12-month trailing basis in 3Q14, according to RCA, while the price per unit increased to $154,798. RERC’s required cap and discount rates for this sector decreased more than for any other property type on a YOY basis in 3Q14, as RERC’s required pre-tax yield rate and required going-in cap rate declined by 80 bps to 9.2 percent and 7.2 percent, respectively. PKF predicts that hotel sector occupancy will reach 65 percent in 2015, which would be the highest occupancy achieved since the recording of this rate started. Investment trends for hotel properties seem to be moving further out from core urban areas for example, Long Island, N.Y., versus Manhattan.

Commercial real estate is a favored investment alternative compared to stocks, bonds, and cash, especially in these uncertain times. Not only does commercial real estate generate high risk-adjusted returns compared to other investments, property is tangible, transparent, a hedge against inflation, and offers reasonable return performance on capital and income. (Income is currently approximately 60 percent of returns.)

Commercial real estate has more than recovered the value it lost in the Great Recession, as shown in Figure 6, and with respect to return performance, broad market prices and values have room to grow for approximately 12 to 18 months. This does not mean that commercial real estate prices and values are sustainable, but for many investors, there are no other good alternatives, and as a result, many investors will continue to pay nearly any price for the value commercial real estate offers.

Kenneth P. Riggs Jr., CCIM, CRE, MAI, FRICS, is president and CEO of Real Estate Research Corp., a Situs company, and publisher of the RERC Real Estate Report. For more information, or for a special CCIM member discount to the report, please contact RERC at publications@rerc.com.

The Utah Chapter of NAIOP recently held its 2014 Year End Commercial Real Estate Symposium titled “Destination Utah”. The event provided a fantastic overview of the Utah Commercial Real Estate Market. Overall, the commercial real estate market in Utah is very strong boasting low vacancy rates, increasing lease rates and a robust commercial real estate investment market that is still providing opportunities for private and institutional investors alike.

There were several take-away’s for me that I found very interesting and telling:

As you can see the market is very strong with a bright 2015 forecast limited primarly by supply of good commercial real estate investment product.

Following are a few other market statistics that are worth highlighting:

OFFICE MARKET

INDUSTRIAL MARKET

RETAIL MARKET

Although difficult to find there are still opportunities to invest in commercial real estate in Utah. Those already invested here are positioned well and may have more value than they may have realized.

Please contact me at brandon@northwoodgrp.com for additional detailed market information or to discuss any commercial real estate needs that you may have.

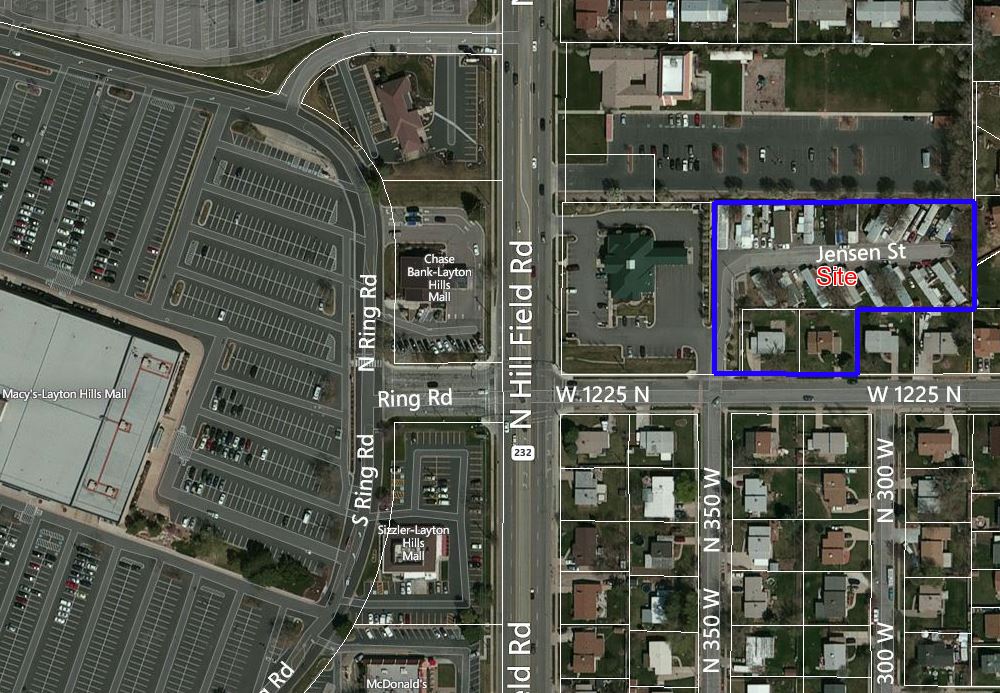

The Northwood Group is pleased to announce the sale of the J&M Mobile Home Park located in Layton, Utah. Contact us for more info on mobile home parks for sale in Utah.

The J&M Mobile Home Park is a uniquely situated commercial real estate investment located just off Hill Field Road across the street to the east from the Layton Hills Mall. It is a rare mix of quiet living and amazing access to services and amenities. All of the mobile homes are owned by the occupants, which is increasingly rare in small mobile home parks. The mobile home park continues to perform well with strong occupancy. The property was priced at an 8% cap rate.

Additional information regarding this sale is available upon request. Find more mobile home parks for sale in Utah by contacting us today.