Sixty real estate leaders came together for the 23rd annual ULI/McCoy Symposium on Real Estate Finance, held in December in New York City.

Invited executives are high-level decision makers from major real estate investment and capital markets firms that are actively investing or lending in the commercial real estate market. Typically, they hail from major Wall Street firms, institutional investment management firms, real estate investment trusts (REITs), private equity firms, commercial banks, insurance companies, and leading private owner/development firms.

All comments made at the invitation-only event are strictly off the record. However, ULI life trustee Bowen H. “Buzz” McCoy shared with Urban Land some key findings and insights from the symposium.

How was the mood at the conference different this year than in previous years?

Everyone was unsettled because of the victory of president-elect Donald Trump. People are off-balance because of the continued uproar, day after day. The fundamental question is the world order and how provocative he gets with Ukraine, Belarus, Taiwan, and Mexico.

Would that affect international investment in U.S. real estate?

McCoy: There could be a de-globalization of real estate. I don’t think it would have such an adverse effect on pricing because it’s such a broad market.

Are there any short-term risks to real estate?

McCoy: It’s Donald Rumfeld’s “unknown unknowns” or a black-swan event. . . . I think that someone like Trump makes a black-swan event more likely. Trump himself is a black swan because nobody factored his victory into their projections. I also think he’s going to be highly inflationary. Increased military spending, increased entitlements, increased infrastructure. The consensus of speakers at the symposium was that inflation will rise to a rate of 3 percent or perhaps 4 percent and unemployment would fall as low as 4 percent. It is hard to find skilled labor. Wages are going up.

Is there any clear direction for real estate?

McCoy: The greatest friend and the greatest enemy of real estate is debt because real estate follows the interest-rate cycle so closely. Those interest rates are, sooner or later, going to increase. So if you are going into risky times, you want to be underleveraged, not overleveraged. And you want to finance long. All sides said that there is tremendous interest in current cash flow. Cash is king, and it all goes back to uncertainty, and Trump is a big part of it.

How will this uncertainty affect the real estate capital markets? For example, experts used to worry about more than $1 trillion in ten-year CMBS [commercial mortgage–backed securities] loans made before the crash that would expire over the next few years.

McCoy: Speakers at the symposium still mentioned the “wall of CMBS,” but with less fear and trepidation. A lot of the good properties got sold. That’s the good news. The bad news is that you don’t want to open the door and look at what is left. Also, banks and insurance companies won’t make loans with terms longer than seven years, but the loans that are maturing are ten-year loans. So there is a gap of about a third, and there is no one around to fund it. Also, what is the likely capitalization rate on the sale of a property? Somewhere between 6 and 8 percent is a normalized cap rate. We are way off from that. CMBS rollovers are also lower loan-to-value. Also, the junk markets are simply not there that were before.

Experts at the symposium also talked about the new risk-retention rules as being an imminent factor for CMBS. The people at the conference weren’t worried about it. The banks are so well capitalized—they thought risk retention could be handled by financial institutions.

How well are banks positioned to handle uncertainty?

McCoy: Commercial bank liquidity is at an all-time high—but the cost of regulation is very deleterious to community banks and small banks, and a record number of them are going under. The Comptroller of the Currency and the Federal Reserve and the Securities Exchange Commission have permanent offices in the large banks.

How is the incoming administration likely to affect these regulations—such as the Dodd-Frank financial reform act?

McCoy: People agree that the banks are safer. Banks say they are too safe. With Dodd-Frank, I don’t think that people who are sensible want a repeal. It’s like Obamacare—you tinker around the margins.

Do you see any signs of a bubble in the property markets? You mentioned that cap rates are unlikely to stay low.

McCoy: That depends what “low” is. We used to think 5 percent was low, when a regional mall sold at a 5 percent cap rate. And then some sell for 4 percent.

Do you see a possibility for a hard landing for real estate?

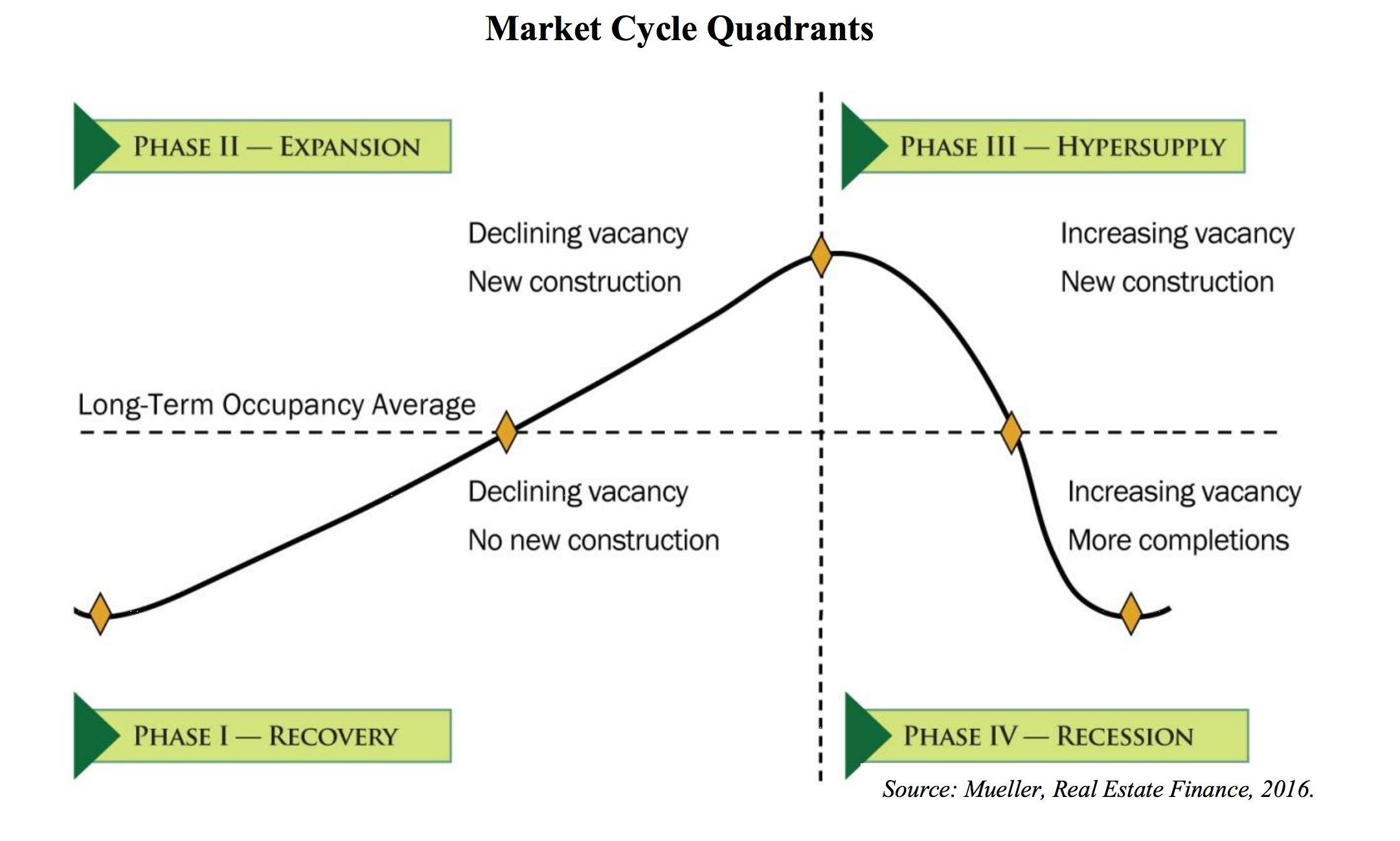

McCoy: It’s more individual sectors and individual cities. A couple of speakers thought that we could have a recession in a couple of years. I thought that was a little extreme. It would be a recession with higher interest rates.

If I were an investor about to buy a property, maybe some strip centers or apartment buildings, what would you advise?

McCoy: I would say borrow now, borrow long, and keep some powder dry.

But what if the only loan I can get is short-term, high-leverage debt?

McCoy: Sell as soon as you can. It’s a time bomb.

We are sailing into unpredictable waters. Real estate generally is in good shape. Keep your powder dry. Avoid overborrowing, but take advantage of still historically low interest rates. Extend maturities. Manage your debt. The next three years could bring about increased risk and turmoil. Be prepared!

Bowen H. “Buzz” McCoy, formerly responsible for the real estate financing unit at Morgan Stanley, is a ULI life trustee and president of Buzz McCoy Associates in Los Angeles. His most recent books are Living into Leadership: A Journey in Ethics (Stanford University Press, 2007) and The Dynamics of Real Estate Capital Markets: A Practitioner’s Perspective (ULI, 2006).