Cityscape

WHERE TO WORK, INVEST AND PLAY IN SALT LAKE CITY

Utah Business Magazine recently published an article titled, “Would You Invest 40 Percent More Money For Sustainable Real Estate?” Here is the link…. (Link to Article). Sustainability has obvious benefits to the environment and to the workplace. It is becoming increasingly cost effective as well. I am really curious where the business community in Utah sits relative to this question. Please share your thoughts.

Full text below:

WOULD YOU INVEST 40 PERCENT MORE MONEY FOR SUSTAINABLE REAL ESTATE?

Judd Bagley, July 19, 2018

For Tiffany Ivins, everything changed while walking along the deck of a boat cruising the Mekong River—a vital waterway for some 400 million people in six southeast Asian nations. After dropping something into the water, she was preparing to dive into the water to retrieve it when a group of her shipmates stopped her. They were there, coincidentally, to measure the river’s out of control pollution levels, and explained to her that the river was full of unsafe levels of carcinogens.

“These hydrologists told us that the reason the Mekong is so dangerous is that Chinese industries dump into it far upstream,” Ms. Ivins says. “We’re homebuilders and know that a lot of building products used in the US come from that part of China. That was our defining moment. We didn’t want to be part of the problem anymore. That’s when we committed that we would only build net zero.” Ms. Ivins and her husband Mitchell Spence own Redfish Builders, a Utah-based homebuilder now known for creating radically energy efficient net zero homes. That means their homes generate all their own energy and emit zero pollutants.

For Redfish, the first challenge was not just to determine whether homebuyers would pay the 30 percent to 40 percent premium for an extremely well-built, energy efficient home, but also whether lenders would risk capital on one. “Everybody was saying, ‘You can’t build a green home and make money on it. There’s nothing for the banks to compare them to’,” says Mr. Spence. “But we knew if we could crack that nut, there was a sustainable business model in there, and we decided to find it.” The first step was attracting investment capital itself.

“Capital is a scared animal. It does not like uncertainty,” says Dr. Laura Nelson, executive director of the Utah Governor’s Office of Energy Development (OED). “And so when it comes to Utah’s policy and regulatory landscape we try to message the importance of certainty and clarity. We believe that markets work and that [consumer] preference is revealed in markets, and increasingly consumers want energy to be not only affordable and reliable but also clean.”

The OED was created in 2011 with a mandate to—among other things—propose policies supporting cost-effective and renewable energy resources. In the OED, Shawna Cuan advises on efficient and renewable energy policy. It was Ms. Cuan who helped Redfish sidestep a major hurdle: how to make it easier for green homebuyers to get mortgages on homes costing more than those of comparable size in the vicinity. “Shawna met with us and said ‘How can the governor’s office help open up pathways for you to accomplish this kind of work?’” Ms. Ivins recalls. “We’d just hit the roadblocks of the appraisers, who didn’t have any kind of complementary training to help them accurately assess the value of a home that generates all the energy it utilizes. She said, ‘We can reach out to the appraisers and offer a training program to build their capacity to assess value around energy efficiency.’”

Next to sustainability, the word that comes up most often when talking with Ivins and Spence about their work is resilience, usually in reference to energy resilience—meaning the ability to operate independently of the energy grid and the inevitable disruptions to service that go along with it. “We’re looking for business models that are resilient and are sustainable in the financial sense, not just in the environmental sense,” says Rose Maizne, partner at Utah-based VC RenewableTech Ventures. “We are a cleantech venture firm, so we only look at companies that have some sort of positive environmental impact. These have to be solutions that save a company money—that cut down costs by a substantial sum by trimming their electrical costs, trimming their water usage, switching to building materials that are not only environmentally friendly but also cheaper and will last longer. Somehow it all has to come back to the bottom line to be sustainable.”

And resilience? “Resilience is another fund criteria, meaning, the economics can’t be dependent on something like a tax credit or a particular regulatory environment nor the price of oil. It must be resilient in that respect,” Ms. Maizner says. “Our portfolio companies are not going to fall victim to short term changes in the macro-economic nor the political environment.” For Mr. Spence, sustainability and resilience mean finding a niche that’s immune to the inevitable peaks and troughs of the business cycle.

“The word sustainable is a very loaded one. We’ve figured out how to build high performance homes that people will pay money for, setting ourselves up above the market,” says Mr. Spence. “Now we’re looking to build a subdivision in Sanpete County where land is cheap and our homes can be sold for $270,000 and we still make the same 20 percent there as on our million-dollar homes up here. If we can do that, we’re recession-proof. That’s what these big developers aren’t doing and it’s the reason our model will endure.”

Creating a sustainable economic and regulatory environment for net zero housing has moved Ms. Ivins and Mr. Spence to take what many would consider to be the counterproductive move of giving their core secrets away. “We’re sharing our learnings and home designs because when the homeowner goes to look for a builder, they’re going to come to us,” says Mr. Spence. “The best part of it is that if they implement it, we’ve helped someone build a better home. The more people that build better homes, the more standard it’s going to become. Our whole objective is to lift the building standard; to create an ecosystem that’s sustainable and profitable.”

Ms. Ivins finds this to be very good for business. “If you build it they will come, and if you collaborate, more of them will come,” she says. Meanwhile, the public sector is approaching ground-level sustainability from a few different angles. Park City recently set the goal of achieving net zero status for city government by 2022, and for the entire community by 2032. Last year, the governors of Utah and six other western states signed a compact encouraging electric vehicle (EV) ownership and interstate travel through construction of a network of EV charging stations at regular intervals along 5,000 miles of freeway traversing the states.

The University of Utah runs the Intermountain Industrial Assessment Center, which teaches engineering students to conduct real world energy audits at no cost for industrial entities throughout Utah. The U also recently launched a program meant to drive down emissions through discounts on electric bikes for students. How is the Governor Herbert’s ambitious energy policy working out for budding new enterprises in need of investment? It would seem to have some ground to cover before Utah becomes a green version of Silicon Slopes. As a VC laser-focused on this world, Ms. Maizner laments the state does a much better job attracting capital for budding high tech than cleantech companies.

“My gut feeling is still that it’s easier to build a software company here than a cleantech company. … I’d like to think that, in a more cleantech-friendly regulatory environment, you’d also see more community support coalesce around cleantech startups, in universities, the startup ecosystem, et cetera,” Ms. Maizner says. “I can think of a half-dozen examples right off the top of my head where companies have had to move their pilot production or demo their products out of state, or, in some cases, have moved out of Utah entirely in order to grow their businesses. I think it’s a missed economic opportunity to not better support these companies and encourage local growth.”

For his part, Mr. Spence has never been more optimistic, as he sees a powerful grassroots-based demand for pro-environment action taking shape in Utah, the Wasatch Front’s infamous wintertime inversions presenting a powerful catalyst. “Our state has never been in a more primed position [to make change]. Bad air is bad air,” Mr. Spence says, noting that 40 percent of air pollution comes not from vehicles but from structures. “It doesn’t matter what your politics are.” And a large part of making that change both ideologically broad-based and sustainable is allowing markets to work their magic. “Socially minded capitalism makes sense,” Mr. Spence says. “And people will pay for it.”

We are proud to announce the sale of the Layton Buy-Direct Building located at 1604 West Hill Field Road, Utah. This property contains 3 separate industrial warehouse buildings for a total of 38,750 square feet.

Please reach out to 801-593-5500 or Brandon@northwoodgrp.com for additional information regarding the sale.

The Northwood Group is pleased to announce the sale of the USA Gymnastics Industrial building of approximately 27,200 total square feet resting on 1.48 acres, located just off of I-15 in Woods Cross Utah.

More information on the sale is available on request- 801-593-5500 or brandon@northwoodgrp.com.

We are pleased to announce the sale of The Carr Printing building located at 580 West 100 North, West Bountiful, Utah. The building is approximately 59,500 square feet. More information regarding this sale is available upon request.

The Northwood Group is pleased to announce the sale of the Ogden Machine Shop of approximately 5,076 square feet sitting on a total of 2 acres. Located just off I-15 in the Intermountain Industrial Park.

More information on the sale is available on request- 801-593-5500 or brandon@northwoodgrp.com.

The Northwood Group is pleased to announce the sale of the Layton Pointe East Land consisting of 4 acres of land in Layton, Utah.

Destination Homes purchased this property for the development of high end town home project. More information on the sale is available on request- 801-593-5500 or brandon@northwoodgrp.com.

We are pleased to announce the sale of the 460 East 1000 North Salt Lake Commerical Office Building. The Northwood Group represented the buyer in the acquisition of this 6,250 square foot, 3 tenant, office building.

Please contact for additional information relating to this sale or other commercial office properties in Utah.

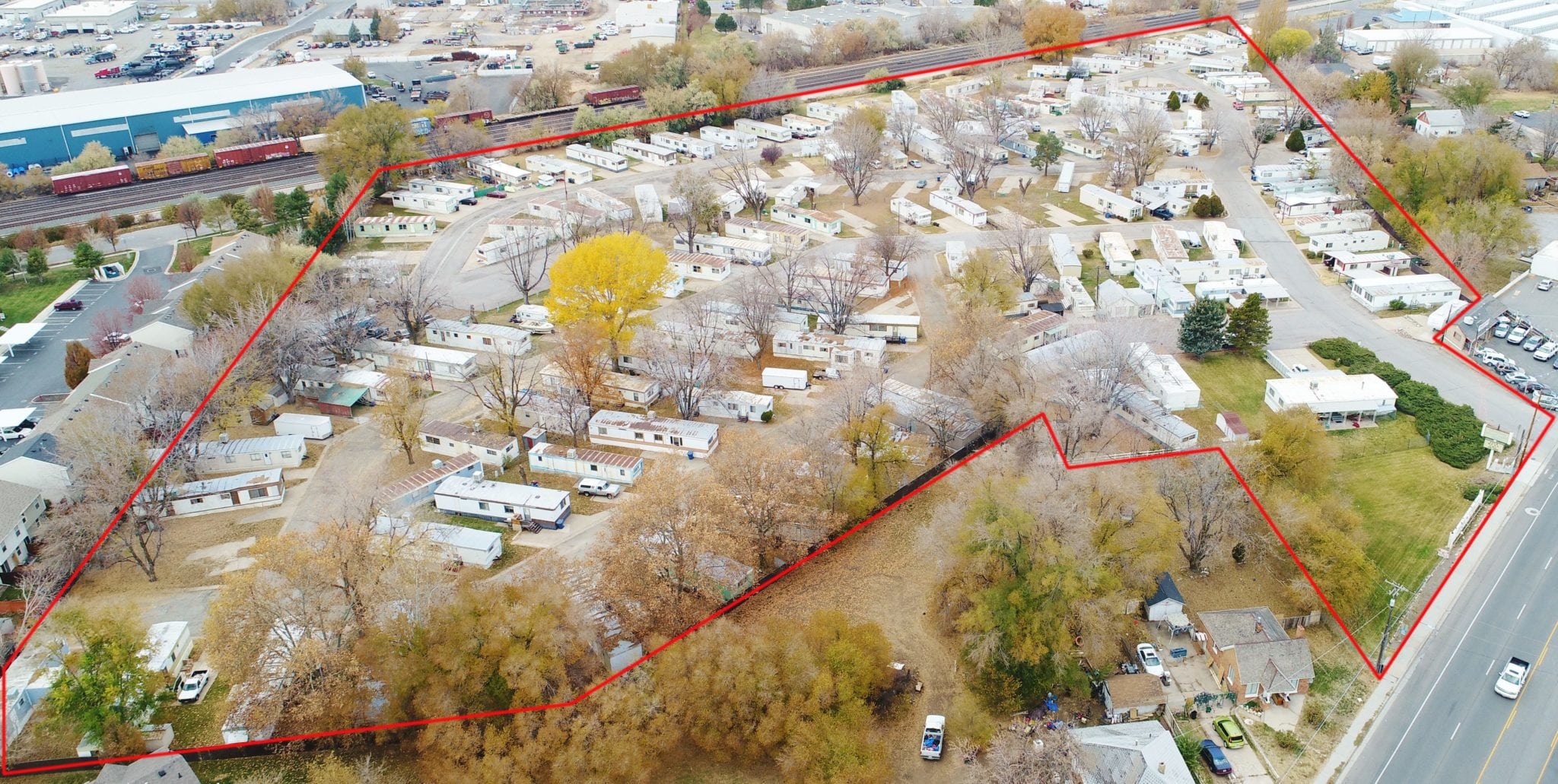

We are proud to announce the sale of the Clearfield Mobile Home Park located at 442 South State Street, Utah, consisting of approximately 15.30 acres. This property sits in the actively redeveloping area of downtown Clearfield. It is also adjacent to The Freeport Center, one of the largest employment centers in the State of Utah.

Please reach out to 801-593-5500 or Brandon@northwoodgrp.com for additional information regarding the sale.

This week I was reading through my most recent issue of Worth Magazine. I enjoy their take on alternative investments. As those of you who know me will often hear me say that every commercial real estate investment needs to be assessed in terms of the next best alternative for those investment dollars.

In this issue they highlighted 15 of the Most Dynamic Cities in America and Salt Lake City made the list. A few of the highlights that caught their eye were:

Pretty impressive accolades. The article went into a detailed interview with Gail Miller and her decision to place the Utah Jazz into a Legacy Trust making a big commitment to her hometown.

Most things I read are from the angle of the impact on commercial real estate investment and as I look at the reasons Salt Lake City is on their list I note that these are many of the reasons that commercial real estate investors choose in any particular market.

I encourage you to read the article. Following is the link:

FULL ARTICLE LINK – CLICK HERE

The full text of the article is below but I highly recommend going to the link above.

When Utah Jazz owner Gail Miller decided to place the NBA team in a legacy trust, she was making a commitment to her hometown.

For most of its 170-year history, Salt Lake City was known primarily as the home of the Mormon religion, a conservative Christian sect whose collective industriousness made the desert bloom in a valley surrounded on all sides by breathtaking mountains.

These days Salt Lake is turning into another type of paradise, luring both millennials and retirees from all over the country who appreciate its health-conscious, sporty, laid-back vibe. The metro area, with more than 1 million residents, boasts broad city streets, bright sunshine and a sparkling clean downtown whose center remains Temple Square, home to the 19th-century Salt Lake Temple, the neo-Gothic Assembly Hall and the domed Mormon Tabernacle.

Salt Lake’s proximity to ski destinations in the snowcapped Wasatach Mountains, only 20 minutes away, has made it a sports enthusiasts’ haven. And with Utah’s business-friendly environment, low taxes and affordable real estate, it also looks to be the next destination for the tech industry. Amazon just announced plans to build a $200 million distribution facility there, and tech startups have invaded the mountains from Ogden to Provo, giving the area the nickname “Silicon Slopes.”

The state’s population is the fastest growing in the nation, with its current real GDP growth rate at 3.4 percent, compared with a national average of 1.6 percent last year, according to the Utah Economic Council. Employment grew by 3.6 percent last year. Salt Lake is also fast becoming a major convention-center city, especially for the controversial multilevel marketing industry that has long had close ties to the state. When Worth visited Salt Lake in June, a convention for Young Living, an MLM company that markets essential oils and is headquartered in Lehi, Utah, was drawing 30,000 conference attendees from around the world.

Mormons no longer dominate Salt Lake, making up only around 40 percent of the population. Politically, the state is staunchly Republican with a Western independent streak, leading 21 percent of the state’s voters to cast their ballots for third party candidate Evan McMullin in the last presidential election. Salt Lake City, meanwhile, is a liberal haven that has one of the largest gay populations in the country; the city’s mayor, Democrat Jackie Biskupski, is a gay daughter of Catholics who grew up in Minnesota and decided to move there after a ski trip to the nearby mountains.

As Salt Lake lurches from its sober religious past to its modern future, it does have one unifying obsession: the Utah Jazz, the NBA basketball team that has called the city home since 1979, when it moved from New Orleans. The Jazz have been owned since 1985 by the Larry H. Miller Group of Companies, which paid Sam Battistone $8 million for a half stake in the team, and then a year later paid another $14 million for the second half. The Miller Group owns 80 other businesses including auto dealerships, movie theaters, a minor league baseball team and an auto financier. Its chairman is Gail Miller, who, with an estimated $1.2 billion worth, became the wealthiest person in the state after her husband, Larry, died in 2009. In January, Miller did something with the Jazz without precedent in modern sports: She placed the team in an irrevocable legacy trust.

Why is that important? Well, while other sports teams may be jostled from city to city, the irrevocable nature of the trust ensures that it can’t be dissolved. As a result, the Jazz can never be sold and will remain a fixture in Salt Lake City, where they are an important part of the local economy. Salt Lake City’s Vivint Smart Home Arena, which is home to the Jazz and was also placed into the trust as it undergoes extensive renovations, is expected to generate $4.4 billion in revenues for the area between 2015 and 2041, according to U.S. commercial real estate services firm CBRE. The Jazz alone are valued at $900 million, according to Forbes. And placing both in the trust shields them from creditors and inheritance taxes.

This groundbreaking move is all part of the stewardship that Miller says stems from her Mormon faith. Worth recently talked with Miller at Salt Lake City’s Zions Bank Basketball Center, where the team practices, to discuss her hometown, why the Jazz matter and how they came to be placed in a trust.

Q: You grew up here, then moved away, then came back and helped start a business empire. now there’s this—the legacy trust. Can you walk us through the history a little bit?

A: Larry and I were both born and raised here. We didn’t know each other until we were 12, and we married at 21. We moved to Colorado because he played softball, and an amateur team in Colorado recruited him. He had to get a job, so he interviewed with a Toyota store there and got the job. It was new in the U.S. This was 1970.

What did that lead to?

He built that up from one store to five. We were frugal. We’d grown up poor. We only lived on what we needed, so we put that money away and invested. We knew we’d come back to Salt Lake City. In 1979, we happened to come back for a family vacation and visited a friend who owned a Toyota store. Larry always asked him, “When are you going to sell me your store?” That day, he asked the question again, and the man said, “How about today?” That was how we bought that first Toyota store. We did not intend to build an empire. We thought we’d have one store. It would be enough to keep us secure for a long time.

When did buying the Jazz become a possiblity?

The Jazz moved to Utah the same year we moved back from Colorado. By then we had five children, and we were busy building our company. In 1985, there was danger of the Jazz leaving—the owner had a buyer from Minnesota who was ready to take them. So the general manager called Larry, and Larry said, “I’m interested in keeping the Jazz,” because he understood how important the team was to the community as a business. The GM came down and talked to Larry, and that’s what started our interest in the team.

Salt Lake City is obviously a special place for you. What do you love about it?

It’s a very big city, but it’s small enough that people know each other. The real charm of Salt Lake City is the heritage that came with the pioneers, because they came with a work ethic that they were all in this together, and they were going to build something worthy of their effort. It was a desert when they came. There was one tree in the valley and a river that came out of the mountain that they used to irrigate the fields. The people have carried on that tradition. When I look at the Jazz and the way they unify this city—it’s something that everybody can get behind and feel good about.

So the Jazz are the pride of Salt Lake City?

They are. If the Jazz ever left, Salt Lake is not going to attract another major league team. We have to be really frugal about how we run the team and how we spend the money, and be creative in getting good players and keeping them.

If the Jazz left Salt Lake, what impact would that have on the city’s economy?

It would be devastating. Because they’re an infrastructure for all of the businesses downtown. They promote business. They draw people into the city to buy things, to spend money at dinner, to go to the game, buying products and paying taxes. It’s a big impact. The other thing is that we don’t draw financially from the city, because we built our own arena.

So what made you decide to put the Jazz into a legacy trust?

This came up as a way to not have to worry about passing it on. The best solution we came up with was the legacy trust. The team is going to be there for as long as it can last. There will be enough money in there to take care of the expenses. I don’t have to worry about it. It’s still run by our company, but it’s not owned by me. It’s owned by the trust, which is irrevocable.

So one of your heirs can’t decide, “Well, wait a minute, we want to sell this.”

No. And the kids are fine with it. They believe in it. They know how important the team is to the community and how important it was to their dad and what it cost for us to do it.

The Jazz constitutes a substantial part of your net worth. Does their new status in the trust mean that the team is no longer considered part of your net worth?

Right.

So you’re not the richest person in Utah anymore?

No. Thank goodness.

You didn’t like that?

It’s an awful moniker. We don’t need all the money we have. We just want to be able to make life good for as many as we can.

What about the NBA? Did the league have concerns about the structure?

We worked with them for 18 months. We were blazing new ground. They are very careful about who can see into their world and what might be exposed by what the owners do. One thing they don’t want to have happen is for the trust to be able to transfer to a foundation.

Why not?

A foundation is vulnerable to government scrutiny. The way I want my estate to work is that when it comes to the end of my life, everything will be sold and all of the proceeds will go into our family foundation and be used in perpetuity for charity. We’re not leaving anything to our children. So in order for us to put the Jazz in a trust, we had to assure the NBA that it would not be sold or ever be given to the charity.

Because it’s in a trust, not a charitable foundation, the team is still a for-profit entity, right? So those profits are plowed back into the trust but you don’t have to pay taxes on them.

Right.

Do you feel you’ll be competitive in terms of having money for player salaries and attracting talent?

Probably more so.

What reaction have you gotten from people in Salt Lake?

They are thrilled. The governor said, “That is a great gift to the state. Thank you for doing it.”

What about the players?

I think the players, too, are quite pleased. I don’t know that it impacts them like it would the management, the staff, the coaches, because their jobs are to stay here and make it work and not have to worry about whether the team’s going to go.

Have you found any resistance from players not wanting to live in Salt Lake City?

There are some things that basketball players who like the nightlife talk about. But it’s not sterile here. It’s not just Mormons. In fact, Salt Lake is only around 40 percent Mormon. Our mayor is a gay woman. We have two councilmen who are gay men. It’s really changing and becoming more open and tolerant. The interesting thing about the Jazz players is that they may balk when they get traded to Utah because they don’t understand it, but once they get here, they’re treated as royalty. The fans are fantastic. They are so dedicated. We are a great basketball town, and we raise our own fans, because we have a Jr. Jazz program that has 60,000 kids in it. That teaches them basketball and builds the fan base to continue loving the Jazz.

Your ancestors were some of the original Mormon settlers here?

They were converted and came to Utah [from Denmark and England] in the 1800s.

How has your Mormon faith affected your decisions with regards to the Jazz?

It sounds corny, but we really feel like what we have is our stewardship, that it doesn’t really belong to us. That somebody out there is watching over us and saying, “You are taking care of it in a way I would like it to be done. You’re doing good things with it. I’m going to help you get more.” That’s the way we’ve looked at our life, that the more good we do, the more comes to us, and then, the more responsibility we have and the more good we can do. In fact, before Larry died, he said, “Wouldn’t it be great if everybody in the world would go about doing good until there was too much good in the world?” Now, think about that. If there was too much good in the world, how would that be?

We are proud the announce the sale of the Family Dollar Retail building located at 750 North Redwood Road, North Salt Lake, Utah. The property consists of a 8,000 square foot and was recently constructed in 2011. Please contact us for more detailed information or for further info on commercial real estate in Utah.